Basics of the U.S. Financial System

U.S. Financial System

Each country uses different forms of money, with some of the most well-known currencies being the Euro, the Japanese Yen, the British Pound, and the United States Dollar.

If you’re relocating to the United States, you’ll most likely start a new career or business. Along with your new job or businesses you’ll be earning U.S. dollars (USD).

In the modern world, U.S. dollars can be used in digital or paper form in any part of the United States. No matter what bank or credit union you use, whether it’s Wells Fargo or Bank of America, your money always has the same value. From California to New York, you can enter any store to buy food, clothes, or gasoline with paper money, credit cards, or debit cards.

Also, you can usually spend USD in most countries worldwide if your credit or debit card permits international purchases. This is especially helpful if you travel frequently or have family in other countries.

However, America’s monetary system might seem overwhelming if you’ve recently arrived in the United States. You’ve probably heard of things like the FICO credit score, checking accounts, 401K funds, and credit unions. These financial tools are something we take for granted in our current financial landscape, but they actually have a long history.

Before we can make sense of these terms, it will help to go back in time and look at the history of the United States financial system. By looking at some of the past problems the United States experienced, we will learn how the U.S. dollar rose from a disorganized currency to the most powerful currency in the world.

After looking at the history of the U.S. dollar, we will take a general look at how the modern banking system works in the U.S.A., including the Federal Reserve, banks, and credit unions.

In this guide, we will answer the following questions:

- What were the early forms of currency in the U.S.?

- What was early banking like in the U.S.?

- Why was the Federal Reserve System created?

- What is the Federal Reserve?

- What is a bank?

- What is a credit union?

What were the early forms of currency in the U.S.?

In the United States’ early years, the banking system was decentralized. This meant that there was no national organization overseeing all the banks in the country, and there was no unified type of money for people to exchange.

Instead, different states and banks used a mixture of currencies such as paper bonds, private bank notes, silver coins, and gold certificates.

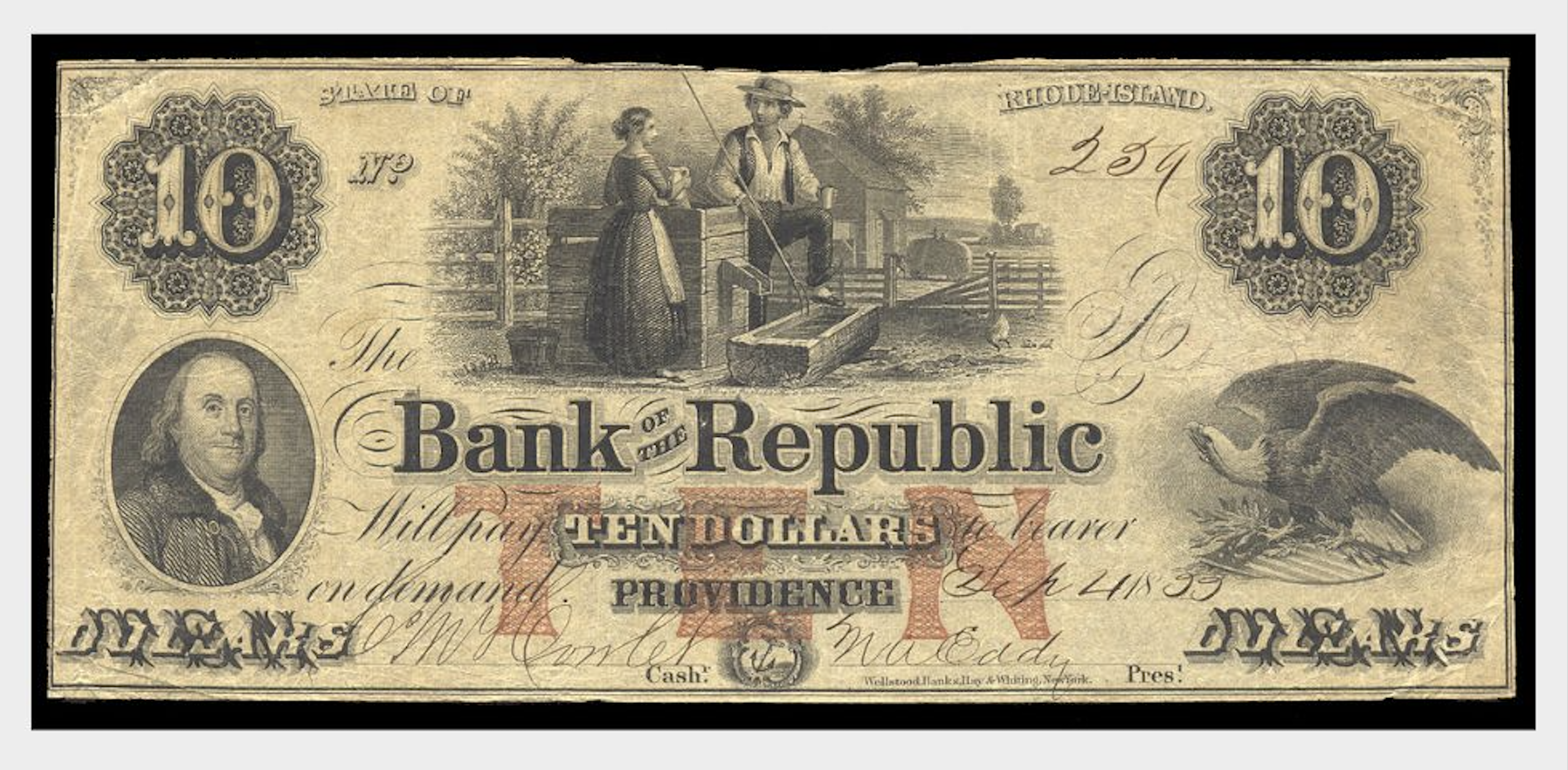

In the 18th and 19th centuries, each private bank gave out certificates to its customers. These certificates were printed on pieces of paper called “banknotes” and featured the bank’s name and address printed on them. The purpose of the banknote was that the person who possessed it could exchange it for gold, silver, or checks issued by the bank.

Along with these private forms of currency, the United States also created the U.S. dollar in 1792. However, in America’s early stages, the dollar was not the only form of currency.

At first, the dollar represented an exact amount of gold or silver that a person could redeem at a bank. But this changed in 1971 when the United States detached the dollar from a specific gold amount. This made the dollar a “fiat currency,” meaning that it has value because the U.S. government authorized it as the country’s only official currency.

10 Dollars – Bank of the Republic, Providence, Rhode Island, USA (21.09.1855), via Wikimedia Commons

What was early banking like in the U.S.?

Before 1913, each bank operated as a private business, and the value of its certificates or banknotes was based on the bank’s reputation. The multitude of banks and currencies often created problems because customers would begin withdrawing their money if a bank was not perceived as stable or trustworthy. When customers withdrew most of the bank’s money, the bank would shut down.

In response to a few regional banks shutting down, a ripple effect would occur, causing people all across the U.S. to panic. Bank customers across the country would then rush to their own banks and withdraw all their money, causing more banks to fail. This phenomenon was called a “bank run.”

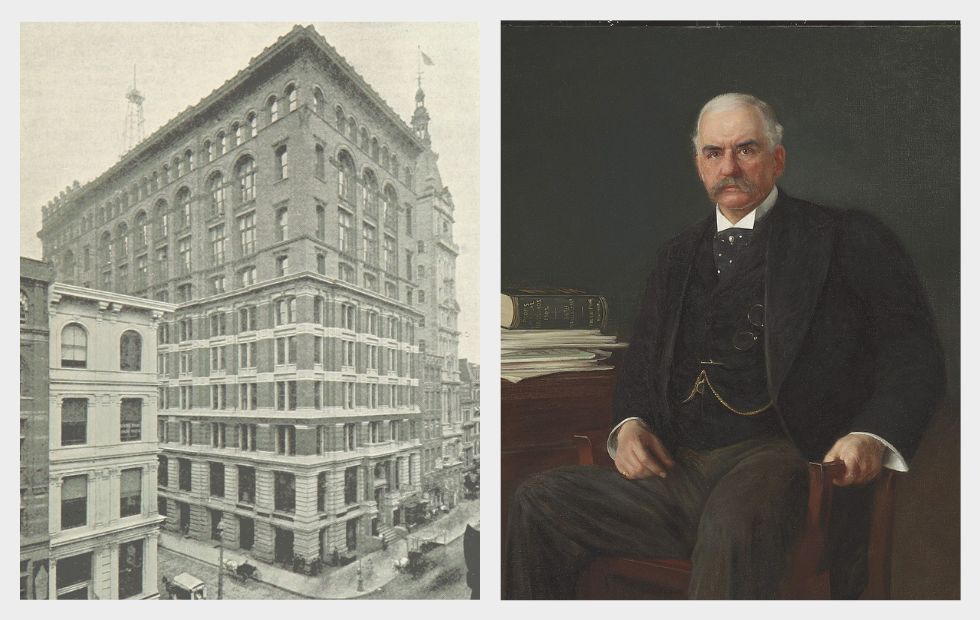

In 1907, bank runs happened in New York City worse than ever before, and the problem rapidly spread across the country. The result was that thousands of banks and businesses in the U.S. ran out of money. This incident is usually called the “Panic of 1907” or the “1907 Bankers’ Panic.”

Luckily, a wealthy banker named J.P. Morgan was able to contribute about $60 million U.S. dollars to private banks to prevent them from going bankrupt. Though J.P. Morgan’s bailout saved the U.S. financial system from failing, it became apparent that the U.S. government needed a way to protect the country’s banks and stock market in the future.

Broadway and Dey Street Showing Mercantile National Bank 1893 | Portrait of John Pierpont Morgan 1903, via Wikimedia Commons

Why was the Federal Reserve System created?

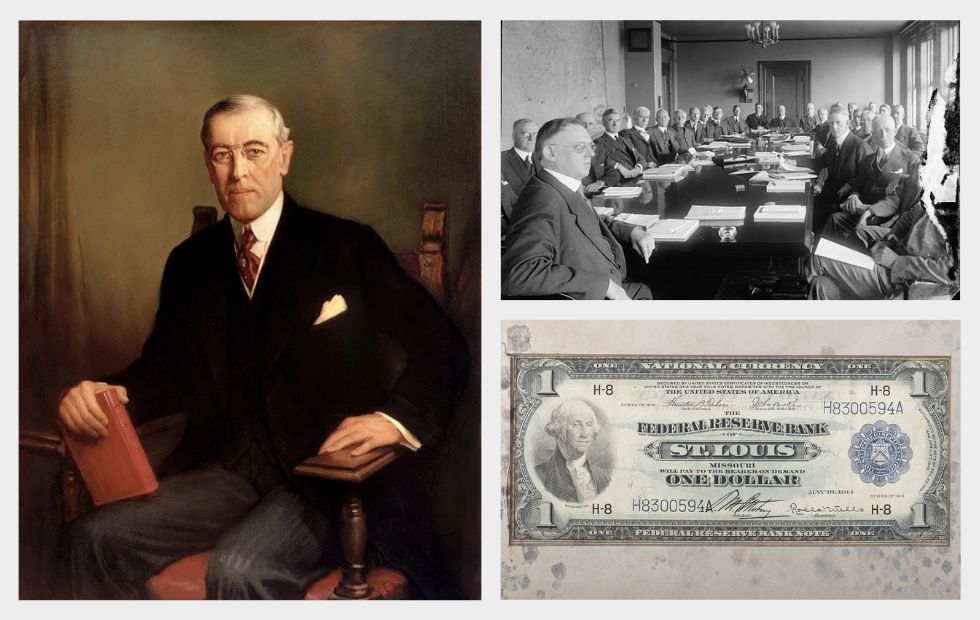

The Federal Reserve Act was signed into law on December 23, 1913, establishing the Federal Reserve System, commonly known as “The Fed,” as the central banking system of the U.S. government.

The Federal Reserve was created as a direct response to the Panic of 1907 when several banks went bankrupt, and the New York Stock Exchange dropped 50% from its previous peak.

The Federal Reserve System was established to avoid repeating financial crises like the one in 1907. As time passed, Congress gave the Fed more responsibilities and authority to handle different money challenges, going beyond the initial steps taken in response to the Panic of 1907.

President Woodrow Wilson | US Federal Reserve Board of Governors Meeting 1922 | Currency Certificate from the Federal Reserve Bank Signed by Rolla Wells via Wikimedia Commons

What is the Federal Reserve?

The Federal Reserve is the central bank of the United States; in other words, the Fed acts as a bank for banks.

The Federal Reserve Bank has the power to create U.S. dollars, make laws regarding money, and supervise the activity of banks. This creates financial stability and safety in the United States because, usually, smaller banks become “members” of the Federal Reserve Bank.

This allows private banks to borrow money from the Federal Reserve Bank in times of crisis. In exchange, the Federal Reserve requires banks to always keep a certain amount of cash on reserve.

Formally, the Federal Reserve Bank has three main goals in the U.S. monetary system:

-

Maximizing employment

The Federal Reserve creates more jobs by adjusting interest rates to make it cheaper for businesses to borrow money, encouraging them to hire more people.

-

Stabilizing prices

The Federal Reserve tries to maintain stable prices for goods and services in the U.S. by carefully managing the amount of money circulating in the economy. If there’s too much money floating around, prices can go up too fast, causing inflation. On the other hand, if there’s not enough money, prices may fall, resulting in deflation.

-

Moderating long-term interest rates

The Federal Reserve maintains stable interest rates when people and businesses borrow money for houses or cars. This helps people and businesses afford loans without paying too much in interest, creating a stable economy where borrowing costs are not too high or too low.

Federal Reserve Building in Washington, D.C.

What is a bank?

Banks are financial institutions that have a license to hold and lend money. People often open an account at a bank to safeguard the money they earn from a job, business, or inheritance. When someone puts money into a bank account, it’s called a “deposit.”

When you become a member of a bank, you usually create two accounts: a savings account and a checking account. Savings accounts are designed for accumulating money over time, while checking accounts are used for everyday transactions.

These accounts give you access to a variety of banking tools like debit cards, credit cards, online banking applications, direct deposits, and automatic teller machines (ATMS) for easy transactions and withdrawals.

The good news is you will also be paid a little bit of “interest” as a reward for trusting the bank with your money. In this case, interest is a small percentage of your deposited money that the bank pays you throughout the year. For example, if a bank pays 0.46% interest each year and you have deposited $10,000 in your bank account, you will earn $46 after one year.

Banks benefit from holding customer money because they use it to make loans for other people and businesses. As customers or businesses pay back those loans over time, they need to pay an extra fee, which is called “interest.”

Essentially, interest is the price it costs for customers to borrow money from the bank, and this is how banks generate a profit.

As your life moves forward, you may need to borrow money for major expenses like purchasing a house or car. In this situation, you can borrow money in the form of a loan while committing to repay it later. As you repay your loan, you will pay extra interest.

Beyond these basics, banks are important for achieving financial goals. They provide a secure environment for saving money and help you build “credit” when you demonstrate responsibility as a borrower.

Modern banks provide secure money management, ATMs, and financial guidance for everyday needs

What is a credit union?

Like banks, credit unions hold and lend money to customers, but unlike banks, credit unions do not earn a profit.

In fact, credit unions are technically owned by their members rather than investors. Because of this, credit unions redistribute their profits back to their members in the form of better interest rates.

Credit unions offer their members most of the same services as banks, such as savings accounts, checking accounts, online banking, credit and debit cards, and ATMs. Similarly, credit unions also offer loans for cars and homes.

However, credit unions are usually specific to a city, state, or region, and many credit unions are designed for the people of a particular community. For example, the Navy Federal Credit Union only allows military personnel, veterans, and family members of military personnel to become members. Some other types of credit unions might be dedicated to city employees, school employees, or those who attend a place of worship.

Credit unions are typically smaller than banks, so joining one can have downsides. For example, if you’re traveling in another state or country, you could have difficulty withdrawing your money. Another downside is that credit unions usually have less advanced technology for online applications than banks.

On the other hand, credit unions usually offer better interest rates and lower fees. Ultimately, it’s up to you to choose a bank or a credit union to hold onto your money.

Credit unions return profits to members through better rates and lower fees

Conclusion

The United States financial system has undergone significant transformations from its early decentralized banking structure to the establishment of the Federal Reserve System.

Today, the US dollar remains the most trusted currency worldwide, pivotal not just for individuals and corporations but also for nations who keep a reserve of U.S. dollars for treasury and international trade purposes.

Now that we’ve established a foundational understanding of the U.S. financial system, our next discussion will focus on the process of opening a bank account in the U.S. There, we will consider things like choosing the right bank, the documents needed to open an account, and different types of accounts that are available.

U.S. Language Services is not a law firm; its content should not be taken as legal advice. For specific legal concerns, please consult a licensed attorney. Similarly, financial information on our site is for informational purposes only, not financial advice. Consult a certified financial advisor or tax professional for advice tailored to your situation.

By accessing U.S. Language Services, you acknowledge that it does not provide legal or financial advice. You agree not to rely on its content as such. U.S. Language Services and its contributors bear no liability for any inaccuracies, losses, or damages resulting from the use of information on our site.

Guaranteed Acceptance

All our certified to English translations are accepted by the USCIS. Our translations follow the guidelines established by the USCIS and are also accepted by educational institutions.

Most Requested Documents

FAQs

You can order most translations 24 hours a day, 7 days a week through our online store. For large projects (more than 20,000 words or 50 pages), please request a quote.