Mortgage for Non-US Citizens: A Definitive Guide for 2021

Granted, the United States is home to people of many cultures and accommodates people from diverse backgrounds. However, getting a mortgage in the United States is no small task—especially for non-citizens.

Thankfully, even though the process of getting a mortgage as a non-US citizen might come with a few challenges, it’s still possible for you to get a loan and secure your dream home in the United States.

In this guide, we’ll be going over everything you need to know about securing a mortgage loan as a non-US citizen. We’ll look at the types of mortgages, mandatory documents for mortgage application approval, top mortgage lenders in the United States, and a glossary of mortgage terms.

Table of Contents

U.S. Language Services LLC is not a law firm and does not provide legal advice. As a result, it is not a substitute for legal counsel. If you need assistance submitting your paperwork, please seek out the advice of a lawyer.

U.S. Language Services LLC is not affiliated with or endorsed by the United States Citizenship and Immigration Services (USCIS) or any other agency of the United States government.

Types of Non-citizens in the United States

All foreigners living in the United States are either permanent or non-permanent resident aliens.

Permanent Resident Aliens

Immigrants who fall under this category possess a green card (issued by USCIS) and a social security number. Unlike a foreigner with a nonresident status, green card holders and U.S. citizens undergo a similar mortgage application process.

Non-permanent resident aliens

Unlike green card holders, immigrants who fall under this category will need to prove that they’ll be residing in the United States over an extended period (and will live in the acquired home).

Non-permanent residents must provide their social security number while applying for a mortgage alongside their Employment Authorization Document (EAD).

When there’s no EAD to present, the borrower will need to provide one of the following visas as proof of legal residency:

- E series visas

- G series visas

- H series visas (H-1B, H-1C, H-2, H-3, and H-4)

- L series visas

- O series visas

- The Mexican and Canadian NAFTA series

- NATO series visas

Mortgage lenders confirm whether a non-permanent resident will live and work in the United States for an extended period of time. So, you will need to provide specific documents as proof of your intentions to reside in the United States for at least three years.

Types of Mortgages in the United States

The three most popular types of mortgages for non-US citizens are conventional loans, government-issued mortgages (FHA loans), and jumbo loans.

Conventional loans

Conventional mortgages refer to home loans not provided by the U.S. government. There are conforming and non-conforming conventional loans.

We regard a conventional loan as conforming when the loan amount provided doesn’t exceed the Federal Housing Finance Agency’s set limit.

On the other hand, we refer to home loans (like jumbo loans) as non-conforming loans when they exceed the FHFA‘s limit for specific countries.

Mortgage lenders providing various conventional loan options might require borrowers to pay private mortgage insurance (PMI) when making an initial payment of less than 20% of the home’s price.

Conventional mortgages, unlike other mortgages, come with lower borrowing costs (even though they might entail a slightly higher interest rate). Borrowers may end up paying as little as 3% down on loans backed by Freddie Mac orFannie Mae.

Conventional loans also grant borrowers the privilege to request that a lender cancel the PMI when they reach a certain level of equity (minimum of 20%).

Borrowers applying for conventional loans (Freddie Mac and Fannie Mae) will have to provide their social security number alongside documents like their proof of income (for a minimum of three years) and proof of residency. You’ll also have to provide a visa and an EAD.

Government-issued loans (FHA loans)

The Federal Housing Administration (FHA) has special mortgage provisions (i.e., the FHA loans) for non-US citizens desiring to become house owners in the United States. The FHA loan is the perfect option for people with no pristine credit and massive down payment.

Borrowers need a down payment of 3.5% and a minimum FICO score of 580 to access the maximum FHA financing of 96.5%. People with a FICO score of 500 can also obtain the FHA loan but will have to provide a down payment of at least 10%.

Prepare to pay two mortgage insurance premiums when pursuing an FHA loan. You will have to pay the first upfront and the second annually for the life of the loan (if your down payment is less than 10%).

Jumbo loans

Jumbo loans are conventional loans (non-conforming) that aren’t as easy to obtain as many other mortgages.

Let’s assume that you desire to get a Jumbo loan. In that case, you’ll need to provide evidence showing that you’ve resided in the United States for over five years. You’ll also have to prove that you’re going to remain employed in the United States over the next three years.

To qualify for a Jumbo loan, you must meet the following requirements:

- You must be able to provide a 30% down payment for the two available home options (a single-family home or a condo)

- You have resided in the United States for over five years

- You can prove that you’ll remain employed even after three years of obtaining the loan

Necessary documents you’ll have to provide when applying for a Jumbo loan are:

- A stamped Form I-94 alongside a valid passport from your home country

- H-1B and H-2B visas

- EAD (to be submitted along with I-140)

Factors Every Lender Will Consider Before Granting You a Mortgage

Your credit score

One of the hurdles you’ll have to overcome to obtain a mortgage is obtaining (and presenting) a good credit score. Since new immigrants seldom have good credit scores, this disqualifies them from getting a U.S. mortgage most of the time.

Lenders often request that borrowers present a credit report with a specific number of trade lines.

A trade line is a credit account such as an auto loan, a credit card, or a personal line of credit.

As a new immigrant with no credit report, you might have to build one over 12 months. You’ll need the credit history of two to three accounts to do this.

Proof of income

Every lender will request that you provide proof of income. You’ll have to present documents showing that you’ve earned consistent income for the last two years.

Documents showing your account balances and liquid assets are also vital. The paperwork will enable the lender to ascertain whether you can provide the down payment and bear other costs.

Assets you present need not be ones you own in the United States. You can also present your foreign accounts and assets, but the documents must all be in English.

Need help with translating your documents? Contact us today. We are a professional translation company and can help to translate all your documents from your native language into English.

Residency status

Lenders consider the residency status of immigrants before giving them a home loan.

Non-US citizens must provide a green card or work visa (with a three-year minimum validity period) as proof of residency.

Mortgage loans are also available for immigrants with no long-term work visa or green card. You can obtain these loans from banks (and other lenders) if you seek to purchase vacation homes and rent specific properties.

Mandatory Documents to Provide to Get a Mortgage

Delays aren’t uncommon when pursuing a mortgage loan, especially when all necessary documents aren’t in place. So, be sure to prepare all paperwork ahead of time.

The documents that a mortgage company would request from a borrower depend on several factors. For example, self-employed non-US citizens might have to provide documents that differ from those that an organization’s employee would present.

In all cases, though, lenders will request documents showing your income reports and debt records.

Below is a list of mandatory documents you should prepare if you seek to obtain a mortgage loan:

Tax returns

Every lender will want to get a complete picture of your financial situation.

Mortgage companies often request that borrowers sign Form 4506-T. By giving your consent, a lender can proceed to obtain your tax returns from the IRS.

Lenders will check to see whether your annual income and pay stubs remain consistent (and don’t fluctuate hugely yearly).

Proof of income

No one will grant a loan to someone incapable of repaying. So, one of the essential documents every lender will request is your proof of income.

Tax returns give lenders an idea of your overall financial health. However, in addition to that, you may have to provide pay stubs from previous months (or other proof of income).

Bank statements and proof of assets

Every lender will assess your risk profile before approving your loan application. For this reason, a mortgage company would request that you provide your bank statements and proof of assets.

These documents help lenders gauge your financial capacity and determine whether you’ll repay your loan, even if emergencies arise.

Checking your bank statement will also verify that your down payments didn’t appear overnight but have been in your bank account for a period of time.

Credit history

Your credit history is an essential factor that will determine whether a lender will approve your loan application. To obtain this information, lenders will review your credit report (with your permission).

Mortgage lenders take note of negative and positive information in borrowers’ credit reports. Be ready to explain the reason for any negative item on your credit report.

Rental history report

First-time homebuyers may have to provide a rental history report. With this document, lenders will assess how swift and consistent you are with paying your rent.

This document is vital, especially for non-US citizens with no substantial credit history. Your rental history report will help lenders determine whether you’ll be able to repay your mortgage loan on time.

Gift letters

Your friends and family may support you with funds for your new home. However, you’ll have to provide a written document from the donor (called a “Gift Letter”) to prove that the money isn’t a loan but a gift.

The document should clearly state the relationship between you and the donor and the amount of the gift.

Photo ID

Lenders will have to confirm your identity. So, you’ll have to provide a valid Photo ID such as a driver’s license.

Top Mortgage Lenders of 2021

This list comprises a list of mortgage lenders, from traditional banks to mortgage lenders for low-income earners.

Quicken Loans

Quicken Loans is a leading mortgage company. One report (see page 62-63) shows that the company originated over 500,000 loans in 2019 alone, making it the most prominent loan originator (based on volume).

Quicken Loans mortgage application procedures are less challenging compared to those of many other lenders. There is less paperwork, so the overall process is often quick and straightforward.

Quicken Loans offers VA, FHA, USDA, and other loan options.

Reali

Reali doesn’t specialize in mortgages only. In addition to that, the company also buys and sells properties.

Anyone can find and purchase a home with the Reali app, even without visiting the property physically (since potential homebuyers can do a virtual tour at their convenience).

Reali helps buyers acquire homes by facilitating both the home loan and purchase process.

Busey Bank

Located in Saint Louis, Missouri, Busey Bank is a top-ranked bank offering traditional banking services alongside mortgage services.

Busey Bank might not be the biggest name on the list of the top mortgage lenders. Nonetheless, this is a bank to keep in mind.

Since its establishment in 1868, Busey Bank has served numerous loan borrowers with its wide range of loan options.

Chase

Chase is a top-ranked bank (and mortgage lender) with over 4000 branches nationwide.

Want to obtain a home loan from a bank? You should check out Chase.

You’ll get access to loan bankers who will offer you professional recommendations on the best loan option to pick.

PennyMac

Not to be mistaken for Freddie Mac, PennyMac is a mortgage lender with loan options suitable for non-US citizens.

PennyMac is a direct lender offering FHA loans with a low down payment. The company’s online operations make the process of acquiring a home loan swift and effortless.

Citi Mortgage

Citi’s HomeRun Mortgage is a perfect solution for low-income households. Even without having savings that cover 20% of your down payment, the company can still offer you a mortgage.

Citi’s HomeRun Mortgage allows borrowers to obtain home loans with a down payment of only 3% and without any mortgage insurance.

The company also accepts down payments provided as gifts and from other outside sources.

Guaranteed Rate

Guaranteed Rate is ideal for anyone looking to obtain an interest-only mortgage.

An interest-only loan will be an ideal option for you if you meet these requirements:

- You intend to sell the property before the end of the interest-only period

- You are a real estate investor

- You are confident you will get a significant pay increase before an increase in your mortgage payment occurs

Guaranteed Rate’s interest-only mortgages come with a payment period of five to ten years.

SoFi

Social Financing (SoFi), which began as a student loan refinancing company, is a recognized mortgage lender offering long-term fixed-rate mortgages.

The journey to obtaining a mortgage via SoFi begins with a short, two-minute pre-qualification stage. Next, you’ll proceed to choose your loan amount and then submit all required documents.

LoanDepot

LoanDepot simplifies the process of refinancing.

The company offers borrowers the advantage of waiving refinance fees after their first refinance and reimbursing appraisal fees for their future refinances.

Mortgage Glossary:

Key Terms Every New Homebuyer Needs to Know

- Adjustable-Rate Mortgage (ARM)

- It’s also referred to as a variable-rate loan. Unlike a fixed-rate loan, an ARM offers a lower initial rate—even though your payments can rise at certain times and to specific amounts.

- Application fee

- Set by the mortgage lender, the application fee is an amount that a borrower must pay to apply for a mortgage.

- Assets

- Valuable items an individual owns, such as stocks, automobiles, and money in a savings account.

- Collateral

- This is any property that an individual presents to serve as security for a debt. The house and land serve as the collateral in the case of a mortgage.

- Conventional loan

- This is a home loan that private lenders issue (and not the federal government).

- Closing costs

- These are fees you pay to finalize a real estate transaction. They may include expenses, taxes, attorney fees, and more.

- Commitment letter

- This letter, issued by mortgage lenders to borrowers, details the mortgage amount, interest rate, annual percentage rate, monthly payments, and the origination fee.

- Conforming loan

- This is a mortgage loan that conforms to Freddie Mac and Fannie Mae’s funding criteria and doesn’t exceed the Federal Housing Finance Agency’s (FHFA) financial limits.

- Construction loan

- This is an interim loan a mortgage lender provides to cover home construction costs. The lender releases payments at periodic intervals to keep the construction going.

- Credit

- The ability of an individual to purchase items or borrow money by paying over time.

- Credit report

- A vital document that lenders use to assess a borrower’s use of credit. This document contains information like the amount of money you’ve borrowed over time from credit institutions, the amount of uncleared credit, and your payment history.

- Credit score

- A unique, computer-generated number that summarizes your credit profile and weighs the likelihood of you repaying future debts.

- Debt-to-income ratio

- A figure (expressed in percentage) that you obtain by dividing the total amount of your monthly debt payments (like credit cards and loans) by your gross monthly income before taxes.

- Deed

- A document handed over to a buyer at closing, confirming the legal transfer of real estate from a seller to the buyer.

- Delinquency

- Failure to pay an agreed amount of money on time.

- Earnest money

- Funds you provide to a home seller as evidence that you’re serious about purchasing a particular home. You won’t receive a refund of this deposit even after the seller accepts your offer. Instead, the seller will channel the money towards your total closing costs and your down payment

- Escrow

- A contractual arrangement in which a third party holds money (or property) on behalf of two other parties, until they meet a specific condition.

- Equity

- Your home’s value above the total amount you are yet to (but expected to) pay for your home. For example, someone who owes $150,000 for a house worth $170,000 has $20,000 of equity.

- Fannie Mae

- This is a government-sponsored organization that purchases mortgages and resells them in the secondary market.

- Federal Housing Administration (FHA)

- This is a U.S. Department of Housing and Urban Development agency that offers mortgage insurance for residential mortgages.

- FHA home loan

- The FHA home loan (also called a government loan) is a loan that the Federal Housing Administration (FHA) issues.

- Fixed-Rate Mortgage

- This is a mortgage with an interest rate that remains unchanged during the loan term.

- Foreclosure

- A legal action against a homeowner to take possession of a mortgaged property when they fail to keep to the mortgage agreement.

- Freddie Mac

- A government-sponsored organization that purchases and securitizes mortgages and resells them in the secondary market.

- Interest-only loan

- This type of loan comes with a decrease in periodic payments since borrowers pay only the interest due for a particular portion of the loan term.

- Jumbo loan

- Also referred to as a non-conforming loan, this is a large loan that’s ineligible for sale to Fannie Mae and Freddie Mac.

- Mortgage insurance

- Insurance that protects lenders from losses in the event of default by a borrower. Most lenders will request mortgage insurance when a borrower makes a down payment of less than 20%.

- Mortgage lender

- The lender (a private institution or government-owned organization) providing the mortgage funds.

- Preapproval

- The conditional agreement by a lender to provide a particular amount of money to a homebuyer under specific terms.

- Prepayment

- This is the money a borrower pays before the principal is due (to reduce the principal balance).

- Prequalification

- An evaluation of a borrower’s ability to repay a loan. During this process, the borrower will have to provide certain information like employment history and proposed collateral.

- Refinance

- This is the act of using the proceeds of a new loan to pay off an existing loan to take advantage of lower interest rates and monthly payments. The collateral remains the same when refinancing a loan.

- Reserves

- These are savings kept by homebuyers to repay their mortgage when emergencies or unforeseen circumstances occur. Reserves are separate from the down payment.

- Unsecured loan

- A term used when referring to a line of credit or loan that isn’t backed by collateral.

- Upfront costs

- These are initial mandatory fees (including the application fees) borrowers must pay.

- VA loan

- This is a mortgage that the Department of Veteran Affairs (VA) guarantees for qualified veterans of the U.S. military forces.

- W-2

- A form that details your earnings alongside the various taxes (local and federal) withheld from your income.

It’s Time to Get Your First Home (Even as a Non-US Citizen)

You’ve always dreamed of owning a home in the United States. Now, it’s time to bring this dream to pass.

No doubt, getting a mortgage as an immigrant with a resident or nonresident status can be challenging. So, to quicken the process, you should be ready to provide every document the mortgage lender will request.

Prepare all your documents, contact a mortgage lender, and begin your application process.

Need help with translating your documents into English? Click the link below. We provide one of the quickest and effective translation services in the United States.

Guaranteed Acceptance

All certified translations are accepted by USCIS, major corporations, professional agencies, and educational institutions.

Order now

Get a free quote

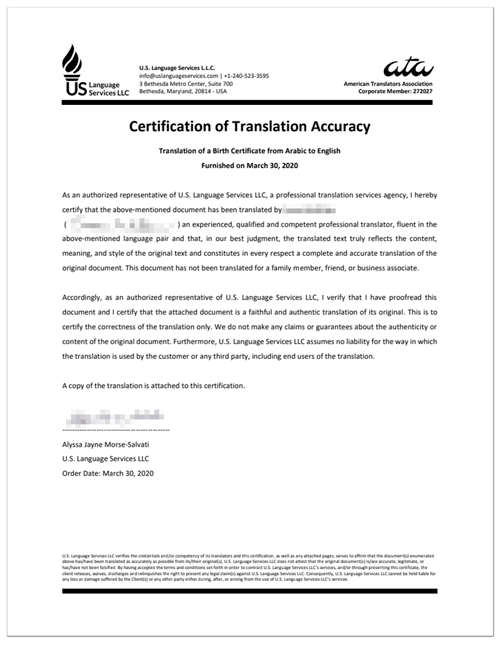

USCIS Certified Translations

According to USCIS regulations, all certified translations must be word-for-word translations and must be accompanied by a certificate of accuracy. U.S. Language Services adheres strictly to these rules to ensure that your documents are accepted. See sample

Get your certified translation quickly and efficiently.

If you’ve arrived here, you’re probably in the middle of an immigration process or involved in legal proceedings that require a certified translation. U.S. Language Services can provide you with a certified translation quickly and efficiently.

- USCIS Acceptance Guaranteed

- 35 languages

- In as little as 24 hours

- ATA Corporate Member

For All Your Immigration Needs

We know how complicated immigration processes can be. Entrusting your certified translation to us will give you one less thing to worry about.

We provide certified translations for all types of documents including:

- Birth certificates

- Criminal records

- Marriage certificates

- Divorce certificates

- Death certificates

35 Languages Supported

We translate to and from English

FAQs

You can order most translations 24 hours a day, 7 days a week through our online store. For large projects (more than 20,000 words or 50 pages), please request a quote.